In today’s world, achieving financial independence for moms isn’t just a desire, it’s a necessity. As a 35-year-old working mom with a small job earning ₹35,000 per month, I understand the pressures of balancing work, family, and the rising costs of living. Like many other mothers, I want to secure a future for my 5-year-old son and give him the best opportunities possible. But how do I ensure I have the financial security to do that?

The answer lies in one powerful tool: investing. Through investing, we can create wealth, achieve financial independence for moms, and protect our families from unexpected events. Whether you’re a stay-at-home mom or working a job like me, it’s never too late to start investing in your future.

Why Financial Independence for Moms is Crucial

The journey to financial independence for moms is about more than just having money in the bank. It’s about having control over your financial decisions, being able to support your child’s dreams, and not relying on anyone else for your financial needs. Here’s why it matters:

- Inflation: The cost of living is always on the rise. By investing wisely, you can ensure that your money grows over time and keeps up with inflation.

- Security for the Future: If something unexpected were to happen—like a job loss or a medical emergency—you’d have a financial safety net.

- Setting an Example: By taking charge of your finances, you set a strong example for your children, teaching them the importance of planning for their future.

- Achieving My Own Dreams: Like many moms, I have personal aspirations beyond just parenting. Financial independence allows me to pursue my own dreams while providing for my family.

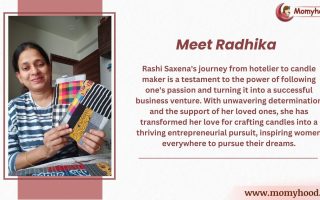

Achieving My Dream of Financial Independence as a Mom was an inspiring story shared by another mom entrepreneur. She took the bold step towards financial security, and her story continues to encourage many women like me.

Steps to Achieving Financial Independence for Moms

If you’re like me, and you’re ready to start investing, here are some simple steps that can lead to financial independence for moms:

Set Clear Financial Goals

The first step toward financial independence is defining what you want to achieve. Are you saving for your child’s education? Planning for retirement? Or are you building an emergency fund? Having a clear vision makes it easier to design an investment plan that aligns with your goals.

Create a Budget

Before investing, it’s essential to know where your money is going. Using the 50/30/20 rule, allocate 50% of your income towards essentials (rent, groceries), 30% towards wants, and 20% towards savings and investments. This helps ensure you’re consistently contributing to your future.

📣 Loved what you read? Want to go deeper into conscious parenting? ✨ The Power of Manifestation in Parenting is now available — A soulful guide packed with real-life tools like affirmations, energy shifts, and sleep talk that I personally use with my son, Hitarth. 💛 Start your journey toward calmer, connected parenting today. 🎉 Launch Offer: Only ₹99 (limited-time price!) 📲 Instant download. No waiting. 👉 Grab your copy now!.

Start Small but Be Consistent

Many moms feel overwhelmed by the idea of investing, thinking they need large sums of money to get started. The truth is, even small investments made regularly can add up. Mutual funds, for example, allow you to start with as little as ₹500 per month.

Build an Emergency Fund

Unexpected expenses are a part of life, especially for moms. Start by setting aside 3-6 months’ worth of living expenses in a liquid savings account. This will provide a cushion while you continue working toward financial independence.

Diversify Your Investments

To reduce risk, make sure you’re not putting all your eggs in one basket. Invest in a combination of stocks, bonds, and real estate. Diversifying helps to spread the risk while increasing the potential for returns. You can look into SIPs (Systematic Investment Plans) as a disciplined way to invest in mutual funds over time.

Get Insured

Financial independence isn’t just about growing your money, but also about protecting it. Ensure you have adequate term insurance and health insurance to cover unforeseen life events. This way, your family’s future is protected no matter what.

Educate Yourself

One of the barriers many moms face is a lack of knowledge about investing. But there are many resources available today—from online courses to books—that make it easier to understand the world of finance. Knowledge gives you the confidence to make smarter decisions and achieve financial independence for moms.

Overcome Fear of Risk

As a mom, it’s easy to be cautious about taking risks, especially when it comes to money. But risk is an essential part of investing. The key is to understand your risk tolerance and invest accordingly. Diversifying your investments can help you manage risk effectively and still achieve strong returns over time.

Common Misconceptions about Investing for Moms

Many moms shy away from investing because of common misconceptions. It’s time to debunk these myths and take the plunge into the world of investments.

- Myth 1: “I don’t earn enough to invest.”

Truth: Even small amounts can grow significantly over time through compounding. - Myth 2: “Investing is too risky.”

Truth: Yes, all investments carry some risk, but diversifying and understanding your investments can mitigate this risk. - Myth 3: “I’ll start investing once I have more savings.”

Truth: The earlier you start, the more time your money has to grow. Delaying can result in missed opportunities for financial growth.

The Importance of Financial Literacy for Moms

One of the most powerful tools for achieving financial independence for moms is financial literacy. Understanding how to budget, save, invest, and manage debt is essential. Many platforms offer free courses on investing and personal finance. As moms, we often prioritize everyone else before ourselves, but taking the time to invest in financial knowledge will pay off for both you and your family in the long run.

For an in-depth look at how to manage finances and achieve financial freedom, check out this guide on financial empowerment for moms.

Conclusion

Achieving financial independence for moms may seem like a distant goal, but every small step you take brings you closer to securing your family’s future. As a working mom earning ₹35,000 per month, I’ve found that it’s not about how much you earn but about how you manage and grow your money. By investing, creating a budget, and educating yourself, you can take control of your financial destiny and ensure a brighter future for your children.

Taking the first step is always the hardest, but remember—you’re not just doing it for yourself, but for your family’s future. So start small, stay consistent, and watch your wealth grow over time.

Your comments and shares do more than just support our blog—they uplift the amazing moms who share their stories here. Please scroll down to the end of the page to leave your thoughts, and use the buttons just below this line to share. Your support makes a big difference!